Why ETF Investing Matters to Global Investors

If you’re a global investor dipping your toes into ETF investing, you’re already on the path to building a diversified, cost-effective portfolio. Exchange-Traded Funds (ETFs) have revolutionized personal finance, making it easier to access broad market exposure without the high fees of traditional funds.

But here’s the catch — not all ETFs are created equal, especially when you cross borders. Understanding the key differences between US-listed ETFs and UCITS ETFs, navigating withholding taxes, and choosing between accumulating or distributing ETFs can significantly impact your investment returns.

In this guide, we’ll break down these crucial elements in simple terms, helping you make smarter choices in your ETF journey.

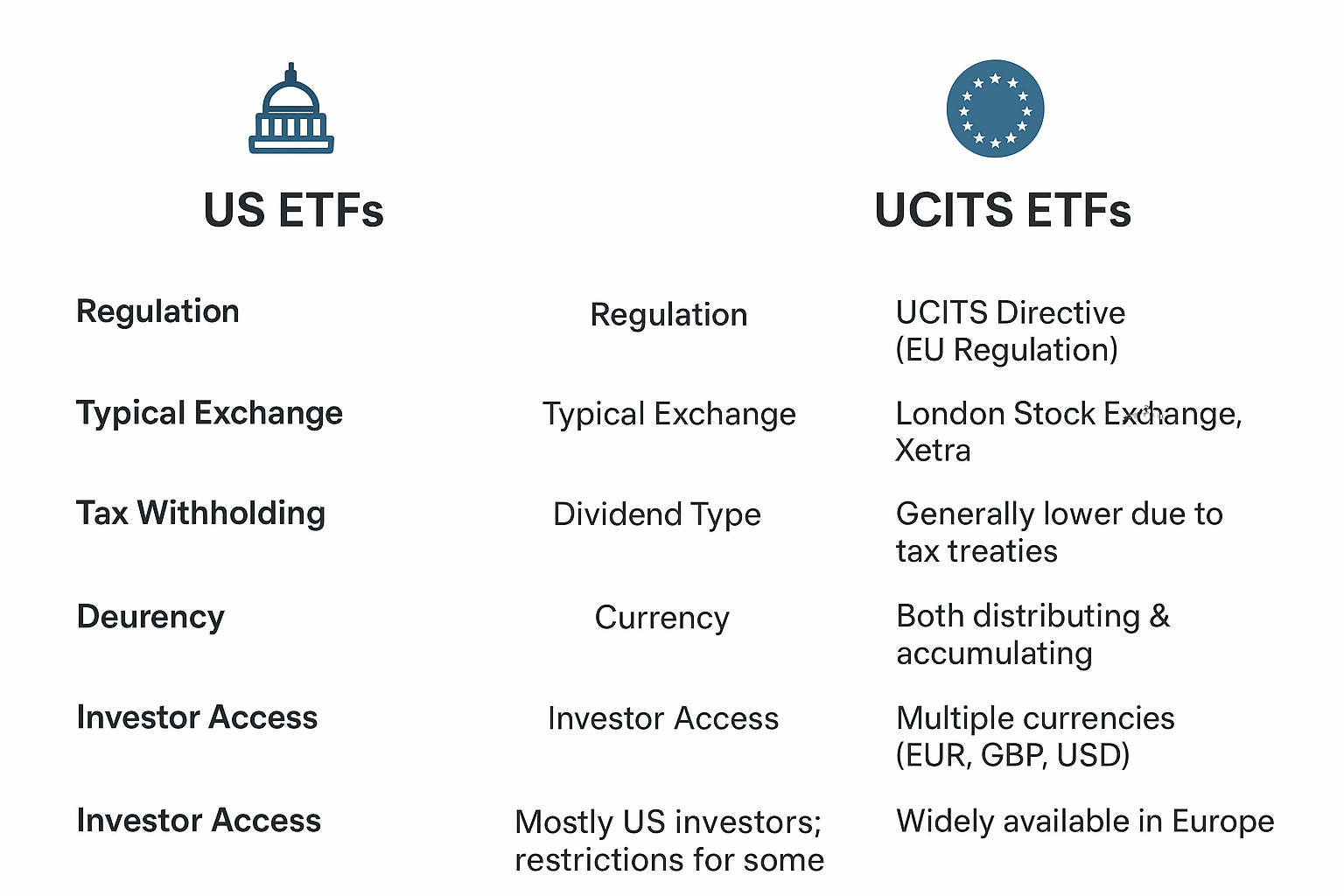

Understanding the ETF Landscape: US vs UCITS ETFs

What Are US ETFs?

US ETFs are funds listed on American stock exchanges like the NYSE or NASDAQ. They are typically regulated by the SEC (Securities and Exchange Commission) and are very popular among US-based investors.

- Popular examples: SPDR S\&P 500 ETF (SPY), Vanguard Total Stock Market ETF (VTI)

- Strengths: High liquidity, broad selection, often lower expense ratios

What Are UCITS ETFs?

UCITS stands for Undertakings for the Collective Investment in Transferable Securities. These ETFs comply with European regulations designed to protect investors and promote transparency. UCITS ETFs are listed primarily on European exchanges such as the London Stock Exchange or Xetra.

- Popular examples: iShares Core MSCI World UCITS ETF, Vanguard FTSE All-World UCITS ETF

- Strengths: Investor protections under EU law, suitable for European investors, easier cross-border distribution

Key Differences at a Glance

| Feature | US ETFs | UCITS ETFs |

|---|---|---|

| Regulation | SEC | EU UCITS Directive |

| Geographic Focus | Primarily US, some global | Primarily European/global |

| Tax Withholding | Higher for non-US investors | Lower or no withholding taxes |

| Dividend Treatment | Usually distributing | Options for accumulating |

| Currency Exposure | Mostly USD | Multi-currency options |

| Accessibility | Limited for some non-US investors | Widely accessible in Europe |

Withholding Taxes: What Global Investors Must Know

One of the biggest challenges for global investors in ETFs is navigating withholding taxes on dividends and interest.

How Withholding Taxes Work

When an ETF pays dividends, a portion might be withheld by the country where the underlying stocks are domiciled before the dividend reaches you. This tax can reduce your overall returns.

- US ETFs: US dividends often face a 30% withholding tax for non-resident investors. However, tax treaties can reduce this to 15% or less, depending on your country.

- UCITS ETFs: These tend to have lower withholding taxes, often because of their domicile in European countries like Ireland or Luxembourg, which have favorable tax treaties.

Why It Matters

For example, if you’re a European investor buying a US ETF, you could face a double layer of withholding tax — one in the US on dividends and another in your home country when you repatriate funds. UCITS ETFs often help mitigate this issue by leveraging tax-efficient domiciles.

Accumulating vs Distributing ETFs: What’s Best for You?

ETF investors often face the choice between accumulating (or capitalizing) and distributing ETFs.

What Are Accumulating ETFs?

Accumulating ETFs automatically reinvest dividends back into the fund, increasing the net asset value (NAV). You don’t receive cash payouts.

- Pros:

- Compounding growth without manual reinvestment

- Simpler tax reporting in some jurisdictions

- Ideal for long-term investors focused on growth

- Cons:

- Less flexibility to access income

- Tax treatment can be complex depending on your country

What Are Distributing ETFs?

Distributing ETFs pay out dividends to investors as cash, usually quarterly or annually.

- Pros:

- Provides regular income stream

- Easier to track income for budgeting or reinvestment

- Preferred by retirees or income-focused investors

- Cons:

- Dividend payments may trigger withholding taxes

- Potentially less tax-efficient if you reinvest dividends manually

Which Should You Choose?

The answer depends on your investment goals, tax situation, and personal preferences:

| Factor | Accumulating ETFs | Distributing ETFs |

|---|---|---|

| Goal | Growth & compounding | Income & cash flow |

| Tax Efficiency | Often better (varies by country) | Potentially less efficient |

| Income Needs | No immediate income | Regular income payments |

| Ease of Reinvestment | Automatic | Requires manual reinvestment |

Personal Experience: How I Navigated ETF Investing Globally

When I first started investing internationally, I gravitated toward US ETFs for their reputation and liquidity. However, I soon realized the withholding tax hit was cutting into my dividend income more than expected. Switching to UCITS ETFs domiciled in Ireland helped me reduce the tax burden, and opting for accumulating ETFs further simplified my tax reporting and accelerated portfolio growth.

It’s a journey many global investors face — balancing cost, tax efficiency, and convenience. The key is to understand your unique circumstances and choose ETFs aligned with your goals and tax domicile.

Tips for Global ETF Investors

- Check the ETF Domicile: Favor ETFs domiciled in countries with favorable tax treaties to minimize withholding taxes.

- Understand Tax Treaties: Research tax treaties between your country and the ETF’s domicile.

- Consider Currency Risks: Holding ETFs in a foreign currency exposes you to exchange rate fluctuations.

- Evaluate Your Tax Reporting Requirements: Accumulating ETFs can simplify or complicate your tax filing, depending on local laws.

- Stay Updated: Tax rules and regulations evolve, so keep informed about changes in ETF taxation and reporting.

Visual Summary: ETF Investing for Global Investors

| Aspect | US ETFs | UCITS ETFs |

|---|---|---|

| Regulation | SEC-regulated | EU UCITS Directive |

| Tax Efficiency | Higher withholding taxes | Lower withholding taxes |

| Dividend Options | Mostly distributing | Accumulating & distributing |

| Accessibility | Limited outside US | Widely accessible in Europe |

| Best For | US-based or tax treaty countries | European/global investors |

Conclusion: Mastering ETF Investing as a Global Investor

ETF investing is a powerful tool for building a diversified portfolio across the globe. But to maximize your returns, you must go beyond picking tickers. Understanding the nuances between US and UCITS ETFs, the impact of withholding taxes, and the pros and cons of accumulating versus distributing ETFs can dramatically improve your investing outcomes.

Remember, there’s no one-size-fits-all answer — your tax residency, investment horizon, and income needs will guide your best choice. Armed with this knowledge, you’re now better equipped to navigate the complex but rewarding world of ETF investing.

Call to Action

What’s your experience with ETF investing across borders? Have you faced challenges with withholding taxes or choosing between accumulating and distributing ETFs? Share your thoughts below or explore our related guides on global investing strategies. Don’t forget to subscribe for more insights tailored to global investors like you!