The world of dividend investing has really changed. High-income Exchange Traded Funds (ETFs) are now everywhere. These funds offer bigger payouts than typical stocks. They do this by using options, which are part of the derivatives market. The most common method is the covered call strategy. Here, ETFs sell call options on stocks they own. This brings in extra money, called premium income, which they give to investors.

Many of these ETFs focus on big indexes like the S&P 500 or the NASDAQ 100. This means their investments are often very similar. However, some ETFs stand out. They might hold different stocks. Or they might use a special covered call strategy. These differences can really affect how much money investors make. This is especially true over the long haul. How much the fund’s value (NAV) stays the same matters too. The fees you pay also play a big role.

This article looks at one covered call ETF that’s quietly becoming popular. It’s not on everyone’s radar yet. What makes it special is its smart covered call strategy and skilled management. This fund aims for a good income. It also works hard to keep its value stable. Plus, it has lower fees than many others. This makes it a really smart choice for income investors.

The Evolution of High-Income ETFs and the Covered Call Strategy

Understanding the Rise of Income-Focused Funds

Investors are always looking for steady income. High-income ETFs have answered that call. They offer a way to get regular payouts. These funds have become a popular choice. They offer a different approach than just owning dividend-paying stocks.

The Mechanics of Covered Calls

The covered call strategy is central to these funds. It’s how they earn extra income. The ETF sells call options on stocks it holds. Think of it like selling the right for someone else to buy your stock. They pay you a fee, or premium, for this right.

The strike price and expiration date of the option are key. The strike price is the price at which the stock can be bought. Selling calls with a strike price higher than the current market price is common. These are called out-of-the-money (OTM) calls. They allow for some stock price growth. Selling calls with a strike price at the current market price are at-the-money (ATM) calls.

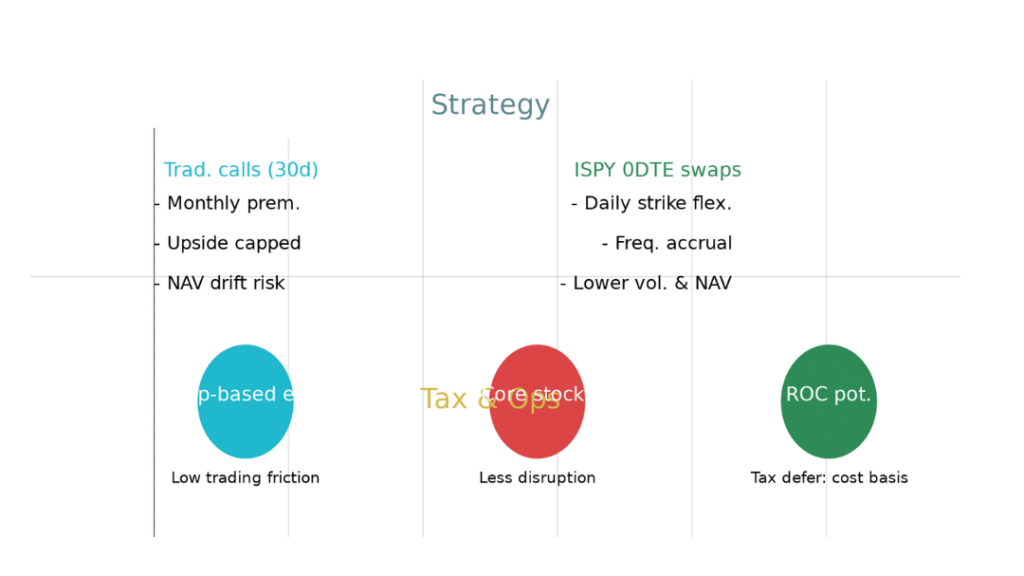

Most covered call ETFs use options that expire in about 30 days. Selling an OTM call with a 30-day expiration caps your potential gains. You get the premium, but you might miss out on bigger stock price jumps. If the stock market rallies hard, these ETFs might not perform as well as the index itself. However, in a down market, the premium income can act as a cushion. It can help reduce your losses.

Why Traditional Covered Calls Can Fall Short

While covered calls can generate income, they have limits. During strong market rallies, these ETFs often lag behind. This is because selling call options limits how much the ETF can gain. The fund’s upside is capped. This can lead to underperformance compared to simply holding the index.

Furthermore, some aggressive strategies can hurt the fund’s Net Asset Value (NAV). This is the actual value of the fund’s holdings. If the fund focuses too much on generating high yields, it might not protect its principal. Over time, this can lead to NAV erosion, meaning the fund’s value goes down.

ISPY: A New Contender in the High-Income ETF Space

Introducing the ProShares S&P 500 High Income ETF (ISPY)

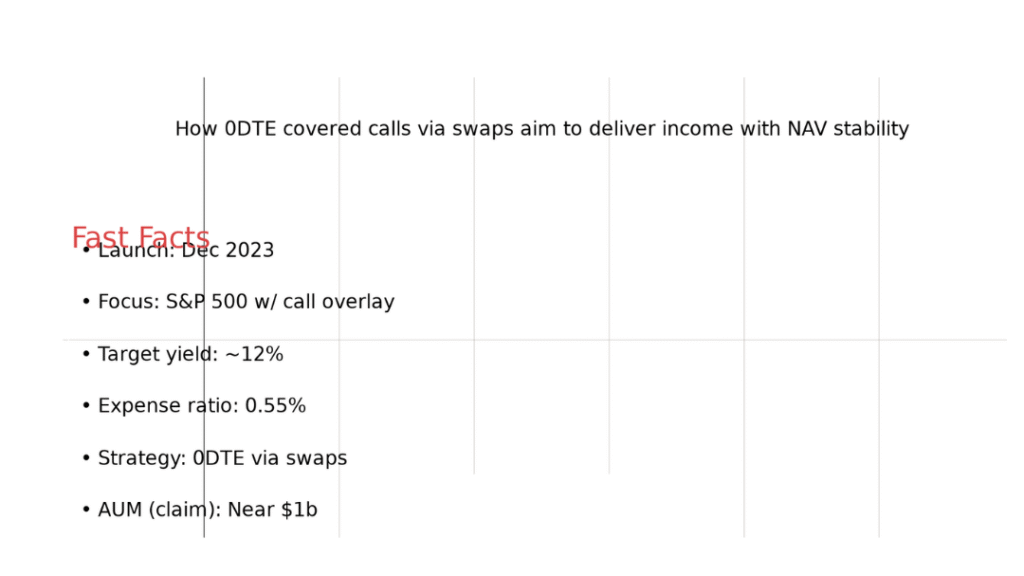

Let’s talk about ISPY, the ProShares S&P 500 High Income ETF. This ETF aims to give investors a solid income stream. It’s relatively new, starting in December 2023. Despite its recent launch, it has already gathered nearly $1 billion in assets.

ISPY targets a dividend yield of around 12%. This is quite high and similar to other popular ETFs like SPYI and GPIX. These funds all focus on the S&P 500 index. They use covered call strategies to boost income.

Performance Snapshot: ISPY vs. Peers

When you look at how ISPY has performed since it started, it’s impressive. It has actually done better than SPYI. SPYI is a well-known S&P 500 covered call ETF. ISPY has also outperformed GPIX for most of its short life.

There was a period where ISPY’s total return was a bit behind GPIX. This was due to a specific market event. In April, the S&P 500 jumped significantly in one day. This happened after a tariff pause announcement. ETFs using covered calls, especially those with very short-dated options, missed out on a big part of that rally.

However, after that big jump, ISPY has actually gained more than both SPYI and GPIX. It has even gained more than the S&P 500 itself. This shows its ability to capture upside effectively.

Management Philosophy: Balancing Income and Stability

The managers of ISPY understand a key point. They know it’s important to balance high income with a stable Net Asset Value (NAV). They don’t chase sky-high yields that might hurt the fund’s value. Instead, they focus on a sustainable 12% yield. This approach is crucial for long-term success.

ISPY’s Unique Covered Call Strategy: The Zero-Day Expiration (0DTE) Advantage

The Power of Zero-Day Expiration (0DTE) Calls

ISPY’s main difference is its use of zero-day expiration (0DTE) calls. Most covered call ETFs use options that expire in about 30 days. ISPY sells options that expire on the very same day. This allows the fund to adjust its positions daily. It can then capture the best strike prices.

This strategy aims to capture more potential upside. It also generates premium income more frequently. Because these options expire so quickly, the fund can react to market movements every day. This gives it flexibility. It also helps with risk management.

Comparison with Other 0DTE ETFs

Other ETFs also use short-dated calls, like QDTE and XDTE. However, ISPY seems to use this approach with more discipline. It focuses on lower volatility and lower fees. The market seems to like this. ISPY has attracted much more money than many other 0DTE ETFs.

ISPY’s expense ratio is 0.55%. This is lower than many typical covered call ETFs. It’s also about half the cost of some other 0DTE ETFs like XDTE, which charge around 1%. Lower fees mean more of your money stays invested.

Impact on Volatility and NAV Preservation

When managed well, the 0DTE strategy can lead to lower volatility. It can also help preserve the fund’s NAV. ISPY’s NAV trend has been steady and strong. This shows that the managers are smart about their income strategy. They prioritize keeping the NAV growing while still paying out income.

Look at how ISPY compares to a similar 0DTE ETF like XCTE. XCTE has had trouble in choppy markets. Its NAV has dropped by nearly 15%. In contrast, ISPY’s NAV has stayed stable. It has even gained about 5% over the same time. This difference highlights ISPY’s strong management.

The Operational and Tax Efficiency of ISPY’s Swap-Based Strategy

How ISPY Executes its Covered Call Strategy

ISPY sells 0DTE call options on the S&P 500. What’s really interesting is that it actually holds the stocks themselves. This is similar to how SPYI and GPIX work. Some other 0DTE ETFs don’t own the actual shares. They just use options to mimic owning stocks.

ISPY’s strategy really shines in how it uses swaps. Instead of selling options every day, it uses swap agreements. A swap is a contract between two parties. ISPY makes a deal with a bank. The bank gives ISPY the daily profit or loss from selling call options. In return, ISPY gives the bank something else. This might be a fixed interest payment.

This setup gives the same income and risk as selling daily calls. But it comes with big benefits.

Advantages of Using Swap Agreements

One big advantage is cost savings. Physically selling many option contracts costs money. This is why some 0DTE ETFs have higher fees, around 1%. By using swaps, ISPY cuts these costs. This helps it keep its expense ratio at just 0.55%.

Swaps also help with managing the fund’s assets. The fund keeps its actual stock holdings. This means the shares are not at risk of being sold. This helps the fund maintain its core investments.

The most important benefit might be tax efficiency. Swaps are not direct option sales. They are considered derivatives. This means much of the income generated can be treated as a return of capital. Income classified as return of capital isn’t taxed right away. Instead, it lowers your cost basis in the fund. Your cost basis is what you paid for the ETF shares. When your cost basis reaches zero, any further payouts are taxed as long-term capital gains. This is usually better than paying taxes at your regular income rate. For investors focused on income, this can lead to better after-tax returns.

The “Return of Capital” Tax Advantage

Distributions that are classified as return of capital are a smart feature. They don’t get taxed in the year you receive them. Instead, they reduce your original investment cost. This tax deferral is a big plus for income investors. Over many years, this can make a significant difference in your overall returns.

Key Considerations for Income-Focused Investors

The Importance of Expense Ratios

Don’t overlook the impact of expense ratios. Even small differences in fees add up over time. Imagine paying 1% versus 0.5% each year. Over 30 or 40 years, that difference can cost you a lot of money. ISPY’s lower fee is a big advantage for long-term investors.

Total Return vs. Dividend Yield

While a high dividend yield is attractive, total return is what truly matters. Total return includes both income payments and any change in the fund’s value. ISPY focuses on preserving its Net Asset Value. This helps ensure sustainable growth. It balances high payouts with stability.

Actionable Insights for ETF Investors

When choosing high-income ETFs, do your homework. Look closely at how they work. Understand their strategies and fees. Consider how they manage risk. Think about how they fit into your overall investment plan. A long-term view is essential.

Conclusion: ISPY as a Superior Choice for Sustainable Income

The world of high-income ETFs has grown a lot. They offer new ways to get regular income. But not all ETFs are the same. ISPY stands out. It uses a unique 0DTE covered call strategy through swaps. This strategy brings cost and tax benefits. Its managers are focused on keeping the fund’s value stable.

ISPY avoids unsustainably high yields. It also has lower fees. This makes it a great choice for income investors. They can get high payouts and also see their investment grow. ISPY’s performance shows it can handle market ups and downs. It’s a strong contender in the high-income ETF space.