Imagine waking up one day, free from the daily grind, sipping coffee on a sunny veranda while pursuing passions you’ve always dreamed about. Sounds idyllic, right? But for many, retirement feels like a distant myth shrouded in confusion and worry. If you’re just starting out, you’re not alone—millions grapple with where to begin. The good news? Retirement planning doesn’t have to be daunting. With a smart approach tailored for newcomers, you can turn that dream into reality. In this guide, we’ll break it down simply, drawing on fresh perspectives like navigating the gig economy and preparing for a longer, healthier life. Let’s dive in and make your future golden years truly shine.

Understanding the Basics of Retirement Planning

Before jumping into specifics, let’s get grounded. Retirement planning is essentially mapping out how you’ll fund your life after work. It’s not just about saving money; it’s about creating a lifestyle that sustains you emotionally and financially. Think of it as planting a tree today so you can enjoy the shade tomorrow.

One common misconception is that retirement is only for the wealthy or those nearing 60. Not true! Starting early harnesses the magic of compound interest—your money grows on itself over time. For instance, if you save $200 a month starting at age 25, assuming a 7% annual return, you could have over $500,000 by 65. Delay until 35, and that drops to around $250,000. The lesson? Time is your best ally in retirement planning.

But here’s a unique twist: in 2025, with people living longer—average life expectancy now pushing past 80—retirement might span 20–30 years. That means planning isn’t just about quitting work; it’s about sustaining vitality. I’ve chatted with retirees who regret not factoring in health costs or boredom. One friend, a former teacher, shared how she wished she’d budgeted for travel classes to keep her mind sharp. So, blend financial prep with personal growth for a fuller picture.

Comparing Retirement Savings Options: Which One Fits You?

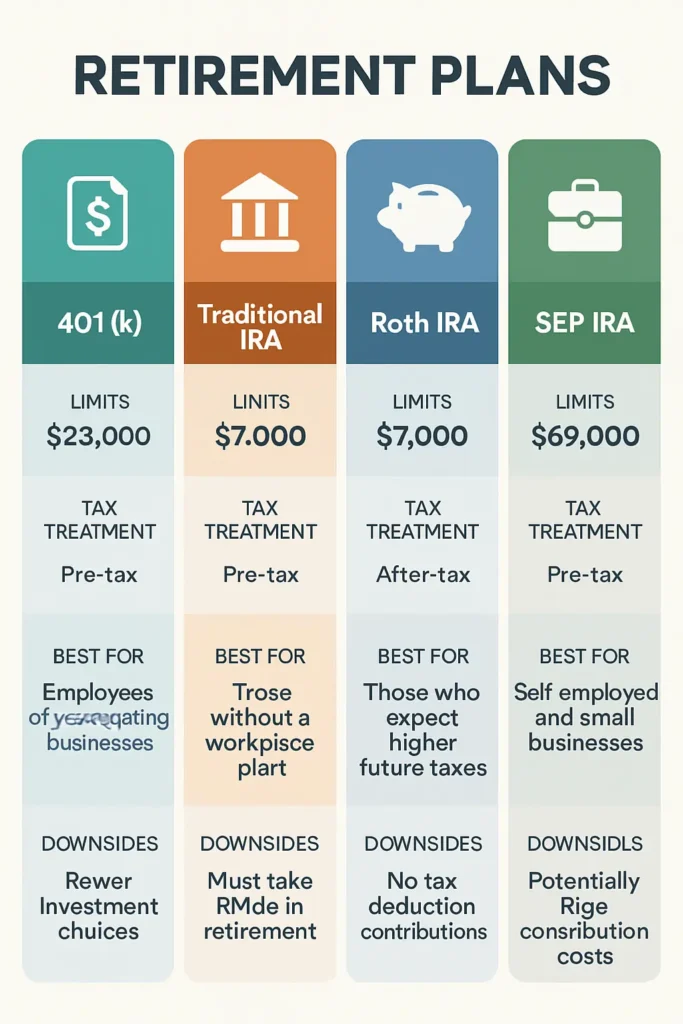

Now, let’s compare popular retirement accounts to help you choose wisely. Not all are created equal, and picking the right one depends on your job, income, and tax situation. We’ll look at key players like 401(k)s, IRAs, and Roth IRAs, highlighting pros, cons, and 2025 updates.

401(k)

A 401(k) is employer-sponsored, often with matching contributions—like free money! In 2025, you can contribute up to $23,500 pre-tax, reducing your taxable income now. But withdrawals are taxed later, and early withdrawals before 59½ incur penalties.

Traditional IRA

IRAs are individual accounts anyone can open. Traditional IRAs offer tax deductions on contributions (up to $7,000 in 2025), with taxed withdrawals.

Roth IRA

Roth IRAs flip it: after-tax contributions now, but tax-free growth and withdrawals later—ideal if you expect higher taxes in retirement.

SEP IRA

For gig workers or freelancers, who make up about 36% of the U.S. workforce in 2025, a SEP IRA might be better. It allows higher contributions (up to 25% of income) and is portable across jobs. The gig economy’s rise adds a fresh layer: variable income means flexible plans are key. Without employer matches, you’re on your own, so automate savings to avoid dips.

Here’s a quick comparison table to visualize:

| Account Type | Contribution Limit (2025) | Tax Treatment | Best For | Downsides |

|---|---|---|---|---|

| 401(k) | $23,500 | Pre-tax contributions, taxed withdrawals | Employees with employer match | Limited investment options, penalties for early withdrawal |

| Traditional IRA | $7,000 | Tax-deductible contributions, taxed withdrawals | Self-employed or no employer plan | Income limits for deductions, required distributions at 73 |

| Roth IRA | $7,000 | After-tax contributions, tax-free withdrawals | Those expecting higher future taxes | Income eligibility limits, no immediate tax break |

| SEP IRA | Up to 25% of income (max $69,000) | Pre-tax, taxed withdrawals | Freelancers/gig workers | No catch-up contributions, higher setup for small businesses |

This table shows why diversification matters—blend accounts for tax advantages and flexibility. A friend in the gig world swears by Roth for its freedom, saying it eased his mind during slow months. Compare your situation: if you’re in a high-tax bracket now, lean traditional; if early career, go Roth for growth.

Key Insights: Step-by-Step Guide to Kickstart Your Retirement

Ready to act? Here’s a beginner-friendly, step-by-step plan infused with unique insights from 2025 trends. We’ll go beyond basics, touching on lifestyle, mental health, and the gig shift for a fresh take.

Step 1: Assess Your Current Situation and Set Goals

Start by calculating your “magic number.” Americans believe they’ll need about $1.26 million for comfortable retirement in 2025, down slightly from previous years due to cooling inflation. But personalize it: factor in lifestyle, location, and health. Use online calculators to estimate—aim for 70–80% of pre-retirement income.

Unique Insight: With longevity on the rise, plan for 100 years. That means sustainable buckets: one for essentials, another for fun, and a third for surprises like medical tech advances. I recall a family member underestimating healthcare; now, at 75, she’s thriving but wishes she’d allocated more for wellness retreats.

Step 2: Build an Emergency Fund First

Before retirement savings, stash 3–6 months’ expenses in a high-yield savings account. Why? Life happens—job loss or repairs—and dipping into retirement funds early kills growth.

In the gig economy, where income fluctuates, make this 6–12 months. Fresh Perspective: Tie it to mental health. Financial cushions reduce stress, letting you focus on long-term goals without fear. Studies show gig workers face higher anxiety from insecurity, so buffer wisely.

Step 3: Maximize Employer Benefits and Automate Savings

If offered, max your 401(k) match—it’s basically a 100% return. In 2025, savings rates hit records, with average 401(k) balances up 15% from last year.

Automate contributions to IRAs too. Set it and forget it; consistency beats perfection. Pro Tip: In a world of AI tools, use apps for robo-advising—they optimize portfolios cheaply, perfect for beginners wary of stocks.

Step 4: Diversify Investments and Manage Risks

Don’t put all eggs in one basket. Mix stocks (for growth), bonds (for stability), and maybe real estate. As a beginner, start with index funds: low-cost, broad market exposure.

Unique Angle: Factor in mental health. Retirement isn’t just financial; isolation can hit hard. Invest in “purpose funds” like community bonds or hobbies that build social ties. One retiree I know invested in a small art studio co-op, blending returns with fulfillment.

Step 5: Review and Adjust Annually, Including Health and Legacy

Life changes—marriage, kids, market shifts—so reassess yearly. In 2025, with Social Security tweaks (benefits up 2.5%), integrate it but don’t rely solely.

Fresh Insight: Address longevity risks. People underestimate living to 95, so consider annuities for guaranteed income. For gig folks, portable health plans are crucial amid rising costs. And don’t forget legacy: simple wills ensure your hard work benefits loved ones.

Quick Wins

- Track expenses for a month to spot savings leaks.

- Educate yourself via free webinars—knowledge empowers.

- Consult a fiduciary advisor for personalized tweaks.

- Incorporate eco-friendly investments; sustainable funds grew 20% in 2025, aligning profit with values.

These steps, laced with real-world nuances, make retirement planning feel attainable. Remember, it’s a marathon—small, steady actions compound into security.

Wrapping Up: Your Path to a Fulfilling Retirement

Retirement planning for beginners boils down to starting now, choosing smart tools, and adapting to life’s curves. By comparing options, following these steps, and weaving in insights on longevity and the gig economy, you’re setting up for more than financial stability—a vibrant, purposeful life.

I’ve seen too many delay and regret it, but others who began modestly now enjoy freedom. You can too. What’s your first step? Share in the comments, or better yet, calculate your retirement number today and subscribe for more tips. Your golden years await—let’s make them shine!