You’re belting coffee on a sunny morning, not fussing about request oscillations, because an AI-powered withdrawal adjunct is still optimizing your investments, tracking your charges, and indeed vaticinating your healthcare costs. That’s not wisdom fabrication — it’s the future of withdrawal planning, and it’s passing now.

For decades, withdrawal planning meant heaps of paperwork, general fiscal models, and the occasional meeting with an counsel. Today, technology — especially artificial intelligence — is making the process smarter, briskly, and far more particular. Whether you’re 25 or 65, these tools are rewriting the rules of fiscal independence.

Let’s explore how this digital shift is shaping the way we plan, save, and live after leaving the pool.

The Old Retirement Playbook vs. The New Reality

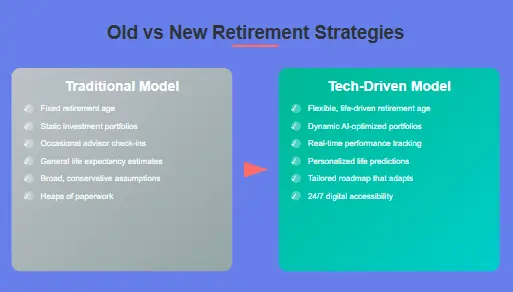

Traditionally, withdrawal strategies followed a predictable pattern:

| Old Model | Tech-Driven Model |

|---|---|

| Fixed withdrawal age | Flexible, life-driven withdrawal age |

| Stationary investment portfolios | Dynamic AI-optimized portfolios |

| Occasional counsel check-sways | Real-time performance tracking |

| General life expectation estimates | Substantiated life prognostications |

In the old system, hypotheticals were broad and conservative. You’d guess your charges, invest in a balanced portfolio, and hope affectation didn’t erode your savings too snappily.

The new reality is more nuanced: algorithms dissect your specific spending habits, health records, and request conditions to give a acclimatized roadmap that adapts as your life does. This is a seismic shift — not just in figures, but in mindset.

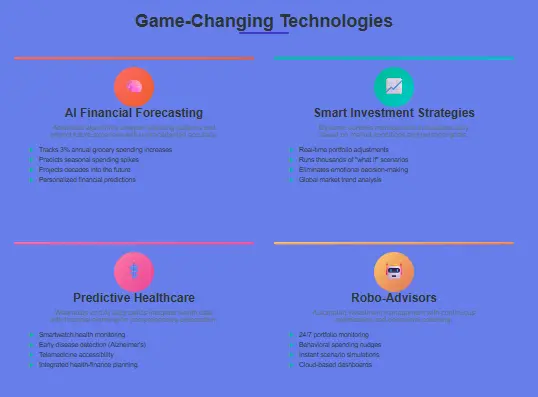

AI’s Game-Changing Role in Retirement Planning

1. Substantiated Fiscal Soothsaying

AI doesn’t just look at your income and charges; it looks at patterns. If your grocery bills rise 3% each time, or if your holiday spending harpoons every spring, algorithms can project that decades into the future. It’s like having a particular fiscal annalist who can also prognosticate the rainfall for your plutocrat.

2. Smarter Investment Strategies

Rather than static allocations (like 60% stocks, 40% bonds), AI-powered robo-counselors acclimate your investments daily — or even hourly — grounded on global request shifts, threat forbearance, and withdrawal pretensions. These tools can run thousands of “what if” scripts in seconds, helping you avoid emotional decision-making during request swings.

3. Realistic Life Estimates

Your lifetime is one of the most critical variables in withdrawal planning. AI tools now dissect inheritable data, life factors, and medical history to prognosticate life more directly. This helps insure you don’t outlast your savings — or save too important at the expenditure of enjoying life now.

The Rise of Predictive Healthcare in Retirement

Healthcare is frequently the largest and most changeable expenditure in withdrawal. Technology is diving that query head-on:

- Wearables: Smartwatches track your heart rate, sleep patterns, and exertion situations, providing early warnings for implicit health issues.

- Telemedicine: Retirees in pastoral areas can now pierce specialists without traveling long distances.

- AI Diagnostics: Prophetic algorithms can spot signs of conditions like Alzheimer’s years before symptoms appear, giving you further time to plan emotionally and financially.

By combining health data with fiscal models, some platforms now offer integrated “health-finance” withdrawal plans. Imagine knowing not just your projected living costs, but also your implicit future medical bills — years in advance.

How Technology Improves Retirement Confidence

24/7 Access to Your Fiscal Picture

Pall-grounded dashboards mean you no longer have to stay for daily statements. You can log in anytime to see your net worth, investment growth, and whether you’re on track for your target withdrawal date.

Script Testing Made Simple

Want to see how buying a holiday home, starting a side business, or delaying Social Security affects your withdrawal? Ultramodern planning tools can run those simulations incontinently, showing the long-term impact in easy-to-read maps.

Behavioral Nudges

AI doesn’t just give you figures; it coaches you. If your spending harpoons, you might get a friendly alert suggesting adaptations. Over time, these micro-interventions can dramatically ameliorate savings discipline.

Implicit Risks and How to Avoid Them

While technology has uncorked inconceivable openings, it’s not without pitfalls:

- Over-Reliance on Algorithms: AI is only as good as its inputs. If your data is deficient or inaccurate, the protrusions will be too.

- Cybersecurity Enterprises: Further fiscal data online means a bigger target for hackers. Strong watchwords, two-factor authentication, and estimable platforms are essential.

- Loss of Human Judgment: Plutocrat decisions aren’t purely fine. Life pretensions, feelings, and values still count — commodity even the smartest AI can’t completely prisoner.

The stylish approach? Combine technology with trusted mortal advice. Let AI handle the computations, and a seasoned counsel help you interpret them in the environment of your life.

Fresh Perspectives: What Early Adopters Are Saying

I recently spoke with a semi-retired couple who began using an AI-driven planning tool five times ago. They participated two surprising takeaways:

- They retired earlier than anticipated — because the system linked that they could sustain their life with part-time work rather than full-time until 65.

- They felt less anxious — knowing they had a plan that streamlined automatically gave them peace of mind, even during request downturns.

Interestingly, they still meet with a mortal counsel once a year, but those sessions are now concentrated on big-picture life planning rather than scraping figures.

What’s Next for Retirement Tech?

Experts prognosticate we’ll see:

- Voice-Actuated Retirement Sidekicks: Imagine asking your smart speaker, “How’s my withdrawal plan looking?” and getting an instant update.

- Blockchain-Grounded Pension Systems: Secure, transparent, and resistant to fraud.

- Hyper-Personalized Income Aqueducts: AI acclimatizing drawdown strategies to minimize levies and maximize continuance income.

As these tools develop, the line between “fiscal plan” and “life plan” will blur even further. Retirement planning will come a living, breathing process rather than a static document in a hole.

Key Takeaways Table

| Trend | Impact on Retirement | Why It Matters |

|---|---|---|

| AI Vaticinating | Substantiated, adaptive plans | More accurate long-term prognostications |

| Wearable Health Tech | Lower healthcare surprises | Integrates health into fiscal planning |

| Robo-Counselors | Dynamic investment operation | Reduces emotional decision-making |

| Script Simulations | Real-time “what if” analysis | More life and spending opinions |

Conclusion: The Future Is Adaptive

Retirement planning is no longer a one-time computation; it’s a dynamic trip that evolves with your life. AI and technology have made it possible to produce substantiated, flexible, and data-driven strategies that give you both confidence and freedom.

But here’s the golden rule: tech is a tool, not a cover for your own values and precedences. The most successful retreats blend smart algorithms with mortal wisdom, creating a plan that works not just on paper, but in real life.

Call to Action

Are you ready to future-evidence your withdrawal? Explore how AI-powered planning tools can give you further control and peace of mind. Start by mapping your current fiscal picture — and watch how technology can turn those figures into a vision for the life you want.